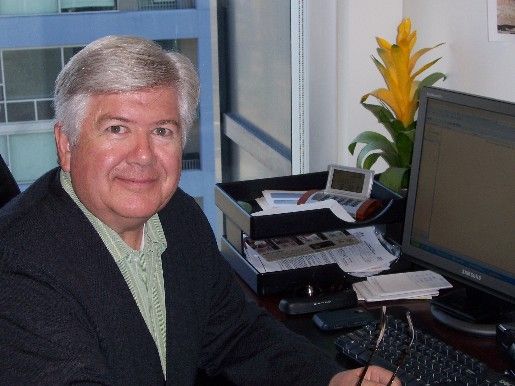

Introduction: We are tax experts who will resolve your IRS problems.

What We Do

* Offer In Compromise Do you qualify to settle for less than you owe? We can help make that determination. Nationwide, according to the IRS, only 14% of submitted offers in compromise are accepted. This, of course, means large dollar amounts often paid up-front to tax help representatives are wasted.

The majority of OICs submitted by our office are accepted. Ask to see successful settlements made by our office.

* Tax Preparation Are you a non-filer? Are you missing income records, W-2s, or 1099s? We can obtain missing records in order to prepare your delinquent taxes. See fee schedule.

* Enforced Collection Do you have a levy on wages or a bank account? We can usually get levies released the first day we meet.

* Abatement of Penalties Do you meet the Reasonable Cause criteria? We can determine if your penalties can be eliminated.

* Bankruptcy (Chapter 7 and Chapter 13) Is your tax liability dischargeable? We can determine if your tax liability can be discharged.

* Limited Liability Companies and/or Partnerships (LLC/LLP) Is this something you should consider for your small business? We can set up an LLC/LLP for you at our initial meeting.

* Delinquent Business Taxes Do you have 941 issues or trust fund penalty? We resolve employment tax problems. Prevent seizure of business.